You Choose

Earn 14.0%

Fixed Returns with

Monthly Payouts

or

Earn 17.3%

Fixed Returns for

Annual Growth

You Choose

Earn 14.0%

Fixed Returns with

Monthly Payouts

or

Earn 17.3%

Fixed Returns for

Annual Growth

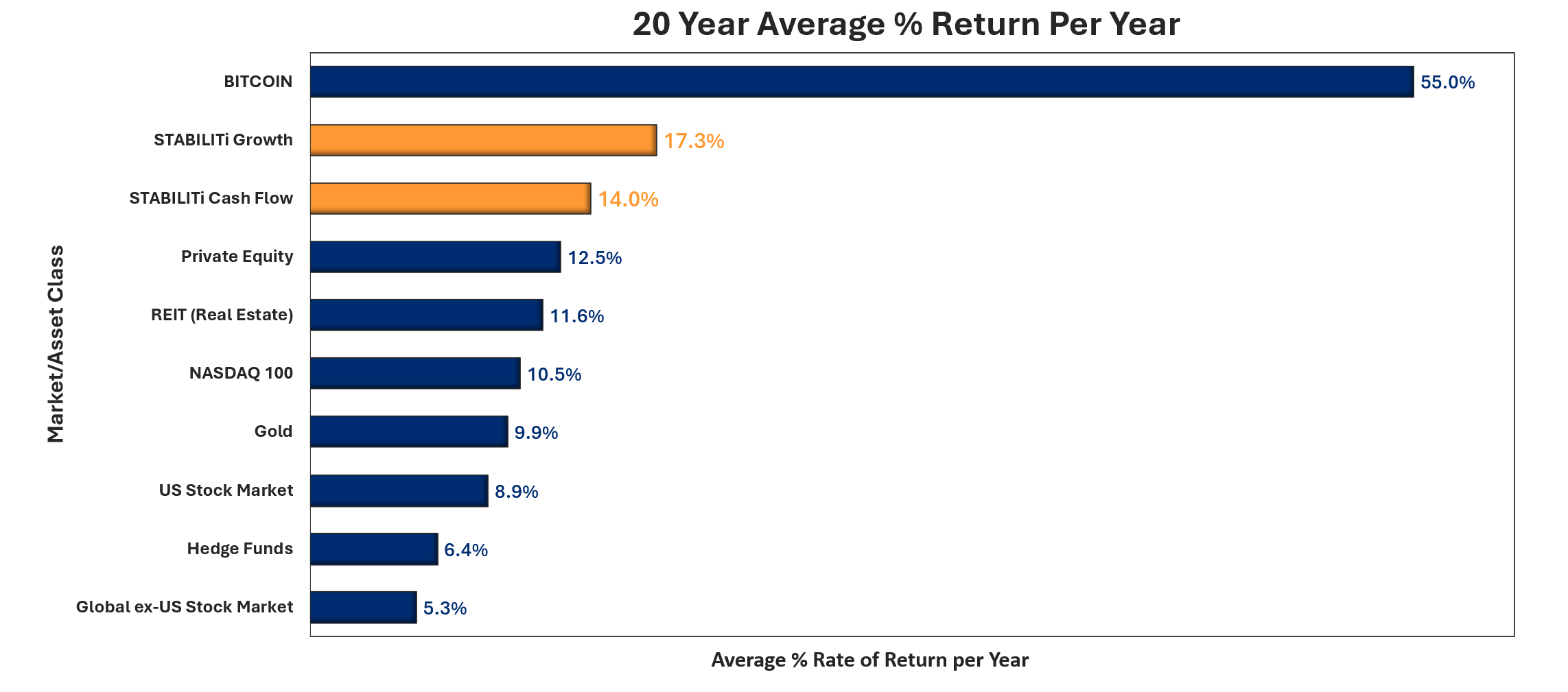

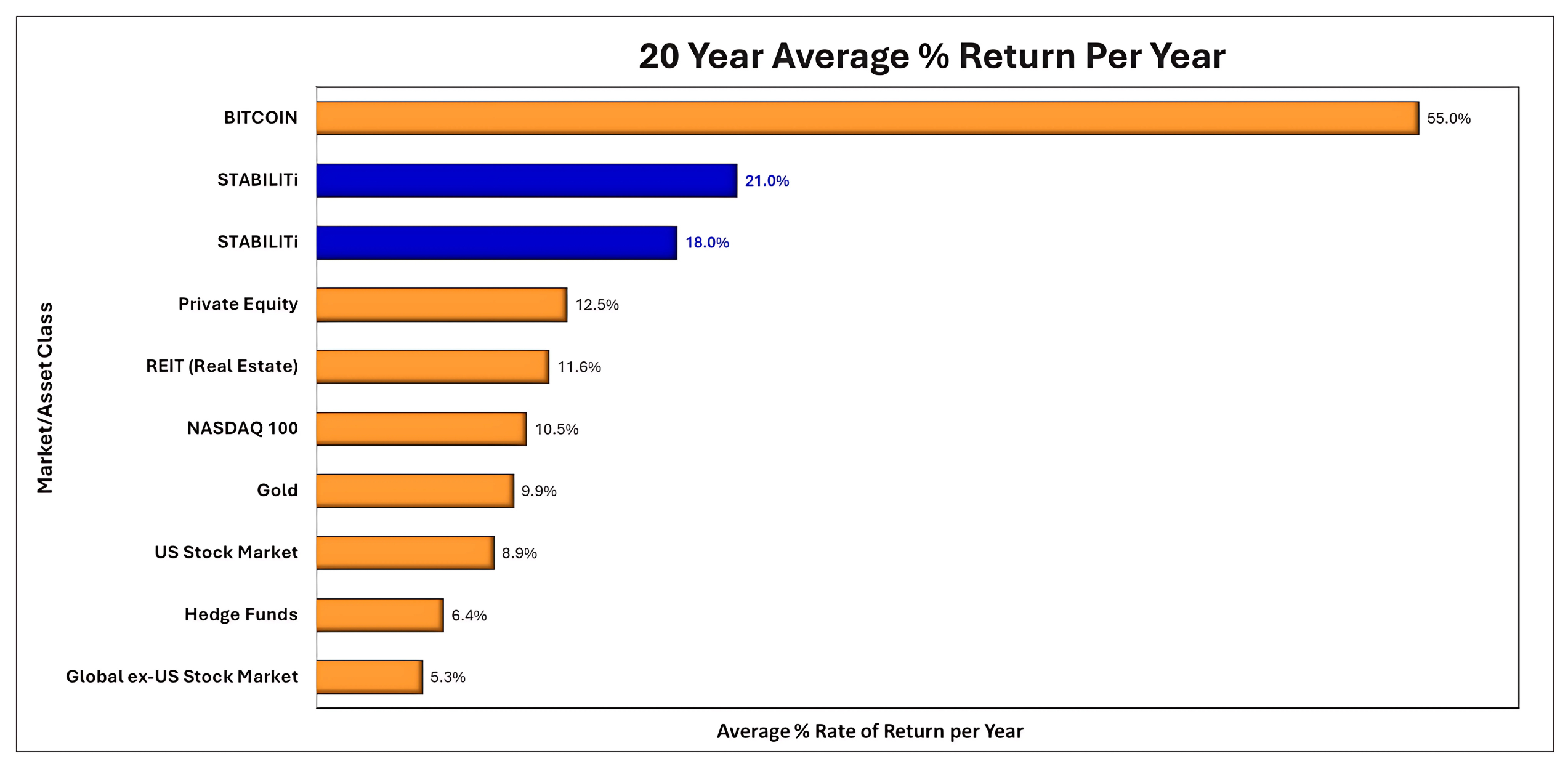

RESULTS

*Source: Bloomberg, as of Dec. 31st, 2024

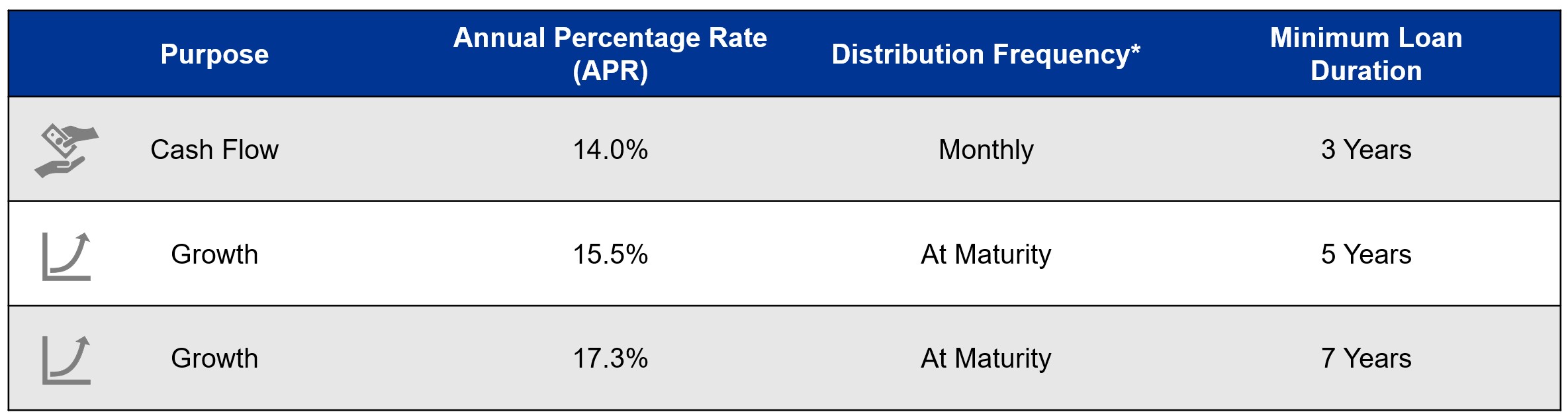

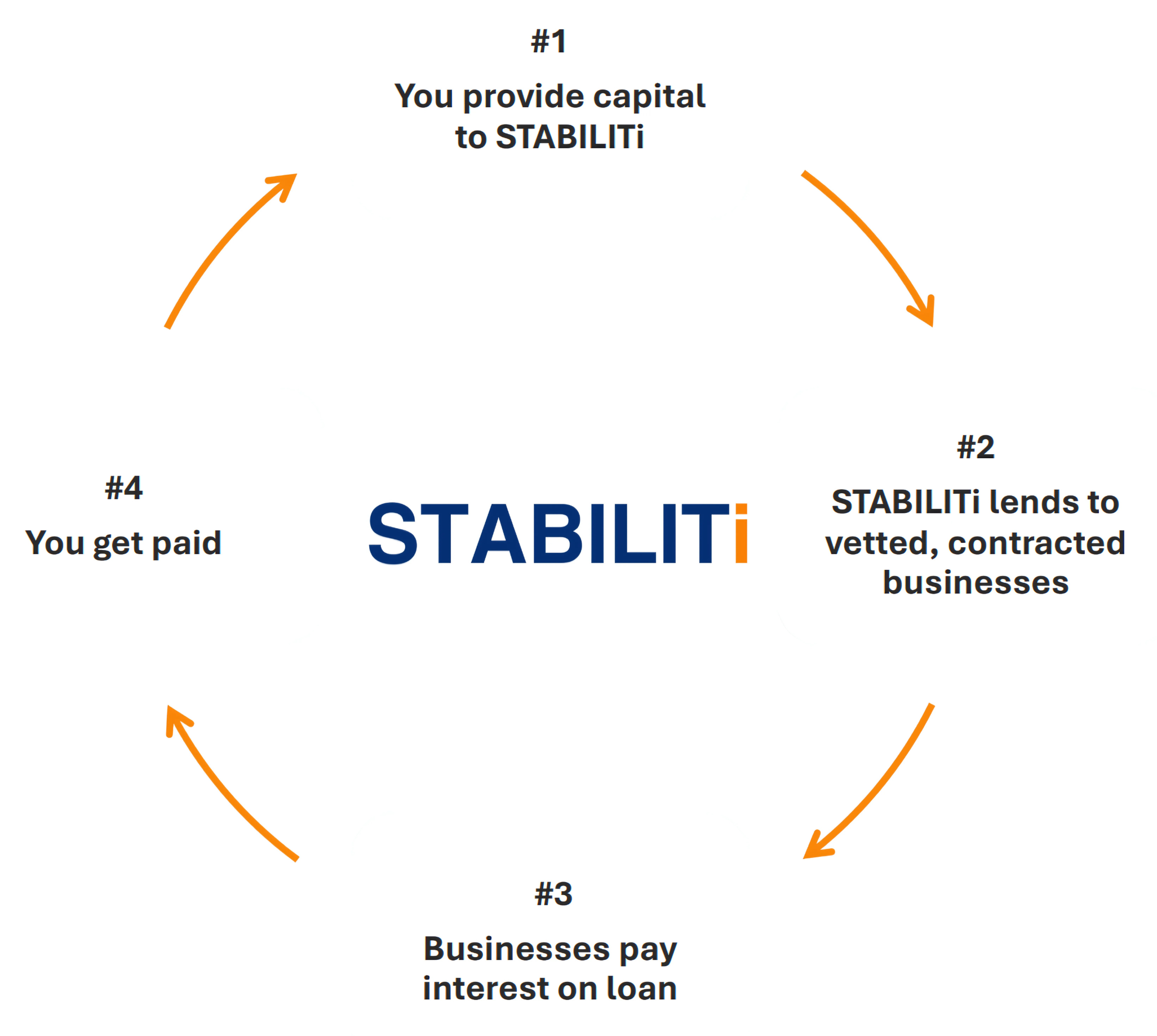

PRODUCTS

Our financial products are designed to offer stability, high returns, and security for our lenders.

Choose a loan tier that works best for your goals and enjoy stable returns.

If you need cash flow each month or long-term wealth growth our 3, 5 and 7-year notes can do that!

Monthly payout distributions are monthly after the first 90-day incubation period.

Early withdrawal (conditions apply) may incur penalties.

Minimum Loan Amount is $25,000.

Our financial products are designed to offer stability, high returns, and security for our lenders.

Choose a loan tier that works best for your goals and enjoy stable returns.

If you need cash flow each month or long-term wealth growth our 3 and 5-year notes can do that!

Monthly payout distributions are monthly after the first 90-day incubation period.

Early withdrawal (conditions apply) may incur penalties.

Minimum Loan Amount is $25,000.

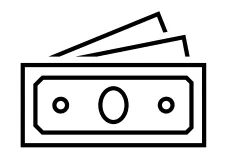

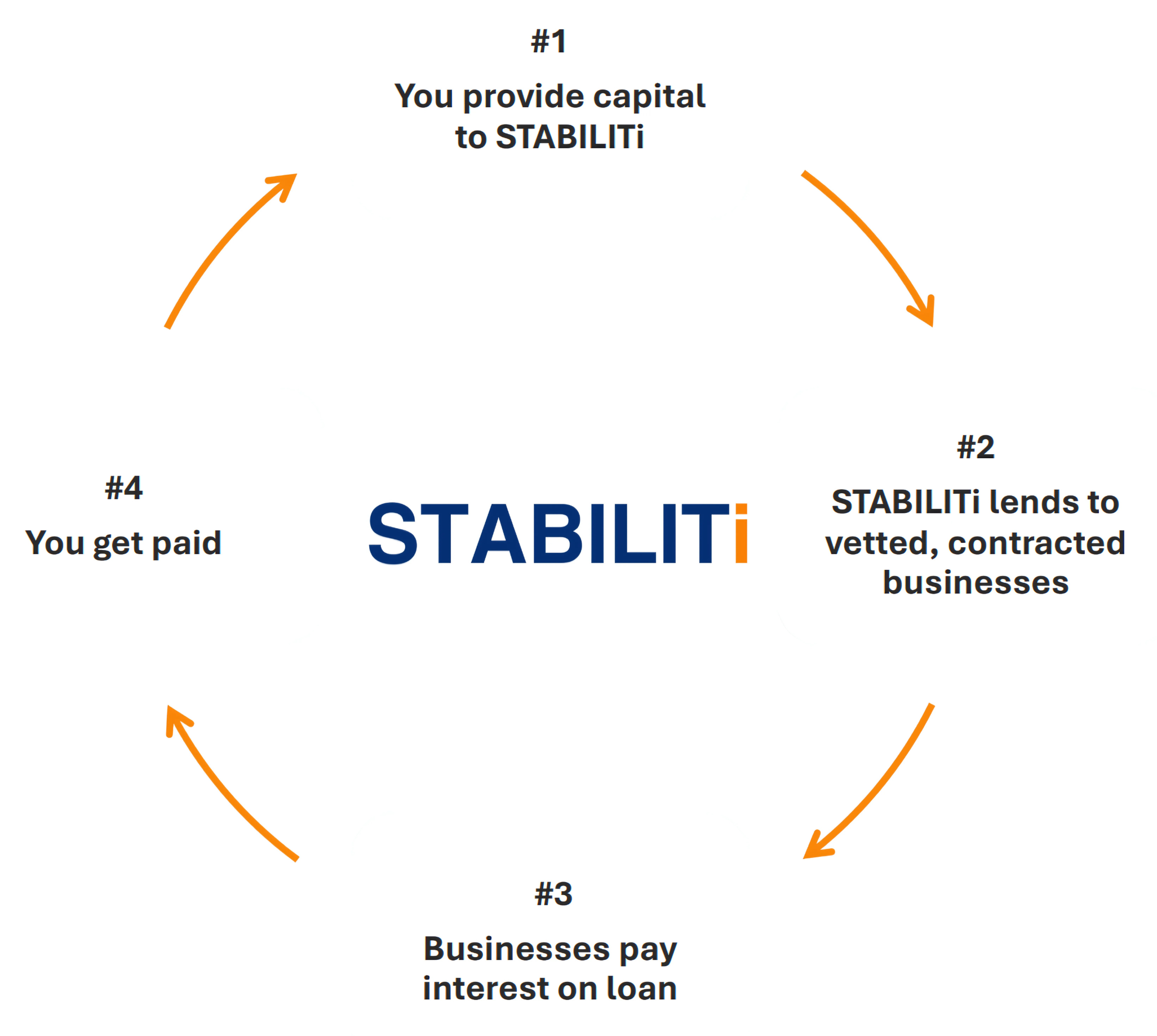

OUR PROCESS

How it works:

1) Lend your Capital with Confidence:

You provide capital through lending and receive structured returns.

2) We loan to Businesses:

Your loan enables businesses to grow from stable cash-flowing business.

3) We Earn Interest:

We collect interest on business loans from stable cash-flowing business.

4) You Receive Payments:

Receive predictable interest payments to meet your financial goals.

How it works:

1) Lend your Capital with Confidence:

You provide capital through lending and receive structured returns.

2) We loan to Businesses:

Your loan enables businesses to grow. from stable cash-flowing business

3) We Earn Interest:

We collect interest on business loans from stable cash-flowing business.

4) You Receive Payments:

Receive predictable interest payments to meet your financial goals.

ABOUT

Our Company:

At Stabiliti, pronounced as "stuh-BIL-ih-tee", we make lending simple and secure. We offer ways to grow your money through generous returns that are safe and easy to understand. Whether you want steady monthly income or big long-term growth, we have plans that work for you.

What We Do

We help small businesses by lending operating capital for business-to-business purposes (e.g., working capital, operational expenses, inventory acquisition, etc.).

Where we do this:

We do this in the in high growth industries in the USA and in safe and reliable, high growth emerging markets.

Examples of Commercial Lending:

Here are real-world examples of how Stabiliti loans can help businesses:

Billboard Company: A billboard company signs a lease for 30 new billboard locations. They need a 120-day loan to buy the materials to build the signs before collecting rent from advertisers. Stabiliti can loan the money and use the contract and materials as collateral. Stabiliti would then be paid a percentage rate of the amount loaned and or a royalty fee on the income the billboard produces.

Manufacturer and Walmart: A manufacturing company signs a deal with Walmart to sell 50,000 units of a new product. They need a loan to pay for the materials and production costs until Walmart pays them for the order. We use the Walmart purchase order as collateral and receive interest on the loan.

Emerging Market Business: A store in an emerging market/country receives a surge in orders during the holiday season. They borrow money from Stabiliti to increase inventory quickly and meet customer demand. Stabiliti receive interest payments from the amount loaned.

Why Choose Stabiliti Global?

Proven Success:

Businesses and investors trust us to deliver consistent results.

Easy Process:

Start lending with just a few simple steps.

Big Returns:

Earn up to 21% per year, much higher than most savings accounts or government bonds.

Steady Income:

Get monthly payments with our 18% plan.

Get Started Today!

Contact us to learn more or start investing today!

Our Company:

At Stabiliti, pronounced as "stuh-BIL-ih-tee", we make lending simple and secure. We offer ways to grow your money through generous returns that are safe and easy to understand. Whether you want steady monthly income or big long-term growth, we have plans that work for you.

What We Do

We help small businesses by lending operating capital for business-to-business purposes (e.g., working capital, operational expenses, inventory acquisition, etc.).

Where we do this:

We do this in the in high growth industries in the USA and in safe and reliable, high growth emerging markets.

Examples of Commercial Lending:

Here are real-world examples of how Stabiliti loans can help businesses:

Billboard Company: A billboard company signs a lease for 30 new billboard locations. They need a 120-day loan to buy the materials to build the signs before collecting rent from advertisers. Stabiliti can loan the money and use the contract and materials as collateral. Stabiliti would then be paid a percentage rate of the amount loaned and or a royalty fee on the income the billboard produces.

Manufacturer and Walmart: A manufacturing company signs a deal with Walmart to sell 50,000 units of a new product. They need a loan to pay for the materials and production costs until Walmart pays them for the order. We use the Walmart purchase order as collateral and receive interest on the loan.

Emerging Market Business: A store in an emerging market/country receives a surge in orders during the holiday season. They borrow money from Stabiliti to increase inventory quickly and meet customer demand. Stabiliti receive interest payments from the amount loaned.

Why Choose Stabiliti Global?

Proven Success:

Businesses and investors trust us to deliver consistent results.

Easy Process:

Start lending with just a few simple steps.

Big Returns:

Earn up to 17.3% per year, much higher than most savings accounts or government bonds.

Steady Income:

Get monthly payments with our 14% plan.

FAQs

General Lending Overview

a. What is alternative commercial lending?

Alternative commercial lending involves providing operating capital to businesses, especially those underserved by traditional financial institutions. Stabiliti focuses on small businesses in markets with significant growth and need for lending. We focus lending in the US, but we also pursue international business lending when a strong and safe opportunity is available.

b. How does Stabiliti differ from traditional lenders?

Stabiliti offers higher returns through short-term, high demand lending market niches and utilizes proprietary fintech solutions to minimize risk and maximize efficiency. Unlike traditional lenders, Stabiliti targets small, high-growth businesses often overlooked by banks.

Products and Offerings

a. What types of loans or notes are available?

Stabiliti currently offers the following interest only loan products:

We offer 2-year, 5 year and 7 year products. See our Product page for current rates.

These programs cater to both cash-flow needs and long-term wealth growth.

Security and Risk Management

a. How secure is my loaned capital?

Stabiliti mitigates risk through diversification, strict borrower criteria, and AI-enhanced fintech monitoring, US-Based contract law, collateral when at all possible and strict financial health of the companies we lend to. We also use KYC and Aml and are subject US based regulatory authorities, namely Federal Trade Commission (FTC) and Consumer Financial Protection Bureau (CFPB) and Financial Crimes Enforcement Network (FinCEN).

b. What measures are in place to mitigate risk?

Risk mitigation includes diversification across millions of small business loans, contracts that hedge against currency volatility, inflation and partnerships with pro-business governments. Strict risk analysis on all companies we lend to, ensuring they are financially able to repay to loans and that the operators have strong incentive to repay, such as a strict contract enforcing loan repayment, collateral when possible and other strict risk mitigation factors in our and your favor.

Eligibility and Requirements

a. Who can lend through Stabiliti?

Currently only lenders that are accredited investors can lend. However, we are working on ways to make it available to the general public, so stay tuned!. Specific eligibility requirements should be discussed with Stabiliti.

b. What is the minimum capital required to participate?

The minimum loan amount starts at $50,000.

Partnership Opportunities

a. Can organizations collaborate with Stabiliti?

Yes, Stabiliti is open to partnerships with organizations that align with its mission to support small businesses. Contact us for details

Tax Considerations

a. Are interest payments taxable?

Yes, interest payments are typically subject to taxation depending on your personal situation. Consult with a tax professional or Stabiliti for detailed guidance.

b. Will I receive tax documentation for my earnings?

Yes, Stabiliti provides necessary tax documentation for lenders to report earnings.

User Onboarding

a. What is the process to start lending with Stabiliti?

The process begins with contacting Stabiliti and completing the necessary documentation. You may start by clicking here:

How It Works

a. What happens after I lend my capital?

Funds are deployed to qualifying businesses within an initial incubation period (60-90 days), interest payments are then distributed monthly thereafter for those that selected monthly distributions, otherwise interest is accumulated and paid back with loan principle at end of term.

b. How do you support small businesses with my loan?

Loans are distributed to small businesses, with a focus on operating capital for high- turnover activities. This helps businesses grow while generating returns for lenders, such as inventory financing, payroll, raw materials, and other business needs.

Returns and Payments

a. How often will I receive interest payments?

For those lender that select the monthly distribution loan, interest payments are distributed monthly, after the initial incubation period, typically 60-90 days.

Legal and Compliance

a. Is this an investment or a lending program?

This is a commercial lending program, not an investment. Loans are secured and interest-only, with terms outlined in formal agreements

b. Are there any regulatory considerations I should be aware of?

Lenders must understand the commercial nature of the transaction and review all legal agreements thoroughly. Stabiliti complies with applicable lending regulations: Federal Trade Commission (FTC) and Consumer Financial Protection Bureau (CFPB) and Financial Crimes Enforcement Network (FinCEN).

Interest Rates and Earnings

a. What factors can affect my returns?

Returns depend on borrower repayment rates, currency stability, and market demand. Stabiliti’s structure minimizes these risks to ensure stable payments.

Loan Allocation Process

a. How are funds distributed to small businesses?

Loans are allocated via US bank to bank money transfers and vetted fintech vendors, targeting small business needs.

b. What criteria do businesses need to meet to qualify for funding?

Borrowers must meet strict criteria, including verified cash flow potential and adherence to local business laws and the ability to repay loans are the primary factors, but we have many more based on the specific type of loan.

Technology and Platforms

a. Is there an online portal for managing my account?

Yes, Stabiliti uses secure digital platforms for account management, monthly reports and fund distribution. Access details can be provided upon onboarding.

b. How secure is the technology used for transactions?

Stabiliti employs industry-standard encryption and proprietary fintech solutions to ensure the safety of funds and data. In additional, our 3rd party partners use: Data security and encryption, Disaster recovery with data redundancy, Data warehouse with unlimited storage, Dashboard access with biometric and multifactor authentication options

FAQs:

General Lending Overview

a. What is alternative commercial lending?

Alternative commercial lending involves providing operating capital to businesses, especially those underserved by traditional financial institutions. Stabiliti focuses on small businesses in markets with significant growth and need for lending. We focus lending in the US, but we also pursue international business lending when a strong and safe opportunity is available.

b. How does Stabiliti differ from traditional lenders?

Stabiliti offers higher returns through short-term, high demand lending market niches and utilizes proprietary fintech solutions to minimize risk and maximize efficiency. Unlike traditional lenders, Stabiliti targets small, high-growth businesses often overlooked by banks.

Products and Offerings

a. What types of loans or notes are available?

Stabiliti currently offers the following interest only loan products:

1) 2 year note 18% annual yield with monthly distributions until cancelled

2) 2 year note @ 21% annual yield – principal and interest distributed at end of two year tern, unless automatically renewed.

These programs cater to both cash-flow needs and long-term wealth growth.

Security and Risk Management

a. How secure is my loaned capital?

Stabiliti mitigates risk through diversification, strict borrower criteria, and AI-enhanced fintech monitoring, US-Based contract law, collateral when at all possible and strict financial health of the companies we lend to. We also use KYC and Aml and are subject US based regulatory authorities, namely Federal Trade Commission (FTC) and Consumer Financial Protection Bureau (CFPB) and Financial Crimes Enforcement Network (FinCEN).

b. What measures are in place to mitigate risk?

Risk mitigation includes diversification across millions of small business loans, contracts that hedge against currency volatility, inflation and partnerships with pro-business governments. Strict risk analysis on all companies we lend to, ensuring they are financially able to repay to loans and that the operators have strong incentive to repay, such as a strict contract enforcing loan repayment, collateral when possible and other strict risk mitigation factors in our and your favor.

Eligibility and Requirements

a. Who can lend through Stabiliti?

Currently only lenders that are accredited investors can lend. However, we are working on ways to make it available to the general public, so stay tuned!. Specific eligibility requirements should be discussed with Stabiliti.

b. What is the minimum capital required to participate?

The minimum loan amount starts at $50,000.

Partnership Opportunities

a. Can organizations collaborate with Stabiliti?

Yes, Stabiliti is open to partnerships with organizations that align with its mission to support small businesses. Contact us for details

Tax Considerations

a. Are interest payments taxable?

Yes, interest payments are typically subject to taxation depending on your personal situation. Consult with a tax professional or Stabiliti for detailed guidance.

b. Will I receive tax documentation for my earnings?

Yes, Stabiliti provides necessary tax documentation for lenders to report earnings.

User Onboarding

a. What is the process to start lending with Stabiliti?

The process begins with contacting Stabiliti and completing the necessary documentation. You may start by clicking here:

How It Works

a. What happens after I lend my capital?

Funds are deployed to qualifying businesses within an initial incubation period (60-90 days), interest payments are then distributed monthly thereafter for those that selected monthly distributions, otherwise interest is accumulated and paid back with loan principle at end of term.

b. How do you support small businesses with my loan?

Loans are distributed to small businesses, with a focus on operating capital for high- turnover activities. This helps businesses grow while generating returns for lenders, such as inventory financing, payroll, raw materials, and other business needs.

Returns and Payments

a. How often will I receive interest payments?

For those lender that select the monthly distribution loan, interest payments are distributed monthly, after the initial incubation period, typically 60-90 days.

Legal and Compliance

a. Is this an investment or a lending program?

This is a commercial lending program, not an investment. Loans are secured and interest-only, with terms outlined in formal agreements

b. Are there any regulatory considerations I should be aware of?

Lenders must understand the commercial nature of the transaction and review all legal agreements thoroughly. Stabiliti complies with applicable lending regulations: Federal Trade Commission (FTC) and Consumer Financial Protection Bureau (CFPB) and Financial Crimes Enforcement Network (FinCEN).

Interest Rates and Earnings

a. What factors can affect my returns?

Returns depend on borrower repayment rates, currency stability, and market demand. Stabiliti’s structure minimizes these risks to ensure stable payments.

Loan Allocation Process

a. How are funds distributed to small businesses?

Loans are allocated via US bank to bank money transfers and vetted fintech vendors, targeting small business needs.

b. What criteria do businesses need to meet to qualify for funding?

Borrowers must meet strict criteria, including verified cash flow potential and adherence to local business laws and the ability to repay loans are the primary factors, but we have many more based on the specific type of loan.

Technology and Platforms

a. Is there an online portal for managing my account?

Yes, Stabiliti uses secure digital platforms for account management, monthly reports and fund distribution. Access details can be provided upon onboarding.

b. How secure is the technology used for transactions?

Stabiliti employs industry-standard encryption and proprietary fintech solutions to ensure the safety of funds and data. In additional, our 3rd party partners use: Data security and encryption, Disaster recovery with data redundancy, Data warehouse with unlimited storage, Dashboard access with biometric and multifactor authentication options

CONTACT

Stabiliti, LLC

30 N Gould St

STE N

Sheridan, WY 82801

Business Hours: M-F 9am - 6pm ET

Phone: (307) 224-6477

Fax: (307) 218-7746

Email: [email protected]

Stabiliti, LLC

30 N Gould St

STE N

Sheridan, WY 82801

Business Hours: M-F 9am - 6pm ET

Phone: (307) 224-6477

Fax: (307) 218-7746

Email: [email protected]